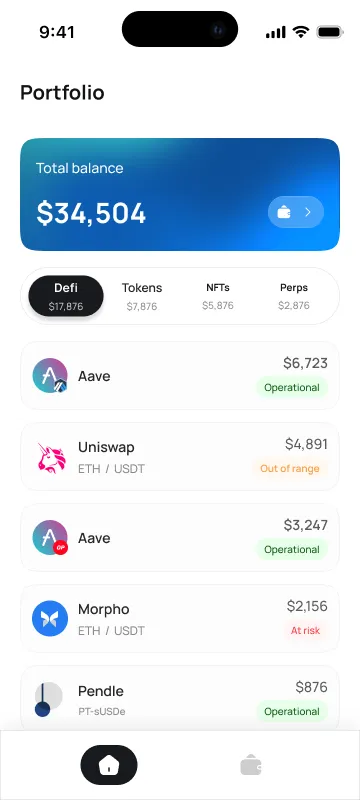

Portfolio

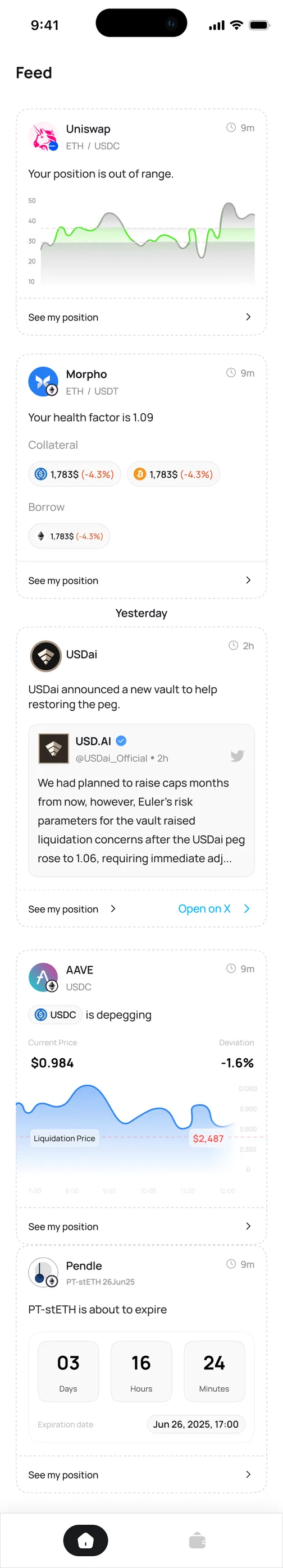

Feed

DeFi Alerts That

Actually Matter

Zero-setup monitoring that understands your DeFi positions and alerts you only when something materially changes.

01

Detect Your

Positions.

Your positions and exposure automatically identified across all supported chains and protocols.

02

Understand

Your Risk.

We analyze what changes actually impact your portfolio. Not generic alerts for everyone.

03

Alert Only

When It Matters.

If nothing important changes, you won't hear from us. That's the promise.

04

One Unified Dashboard

To Rule Them All.

Stop switching between apps. See your entire DeFi portfolio in one place.

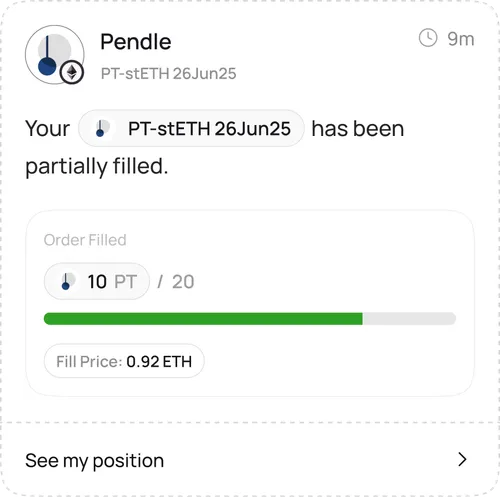

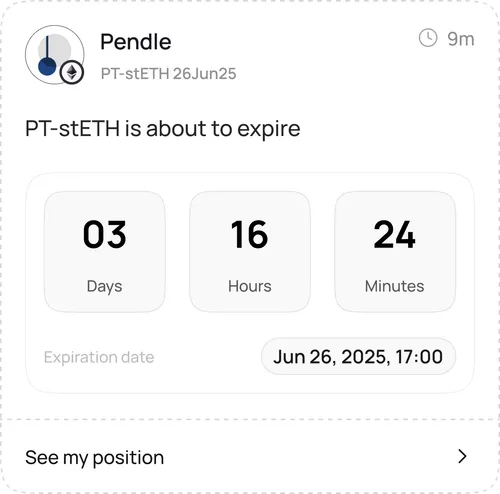

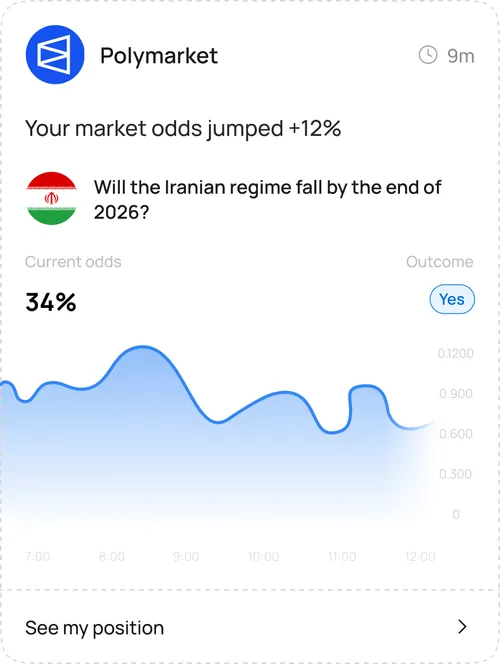

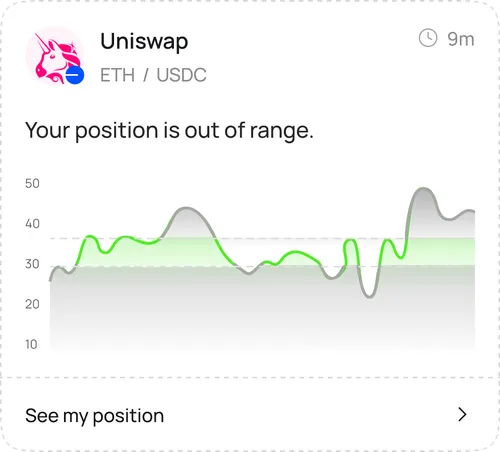

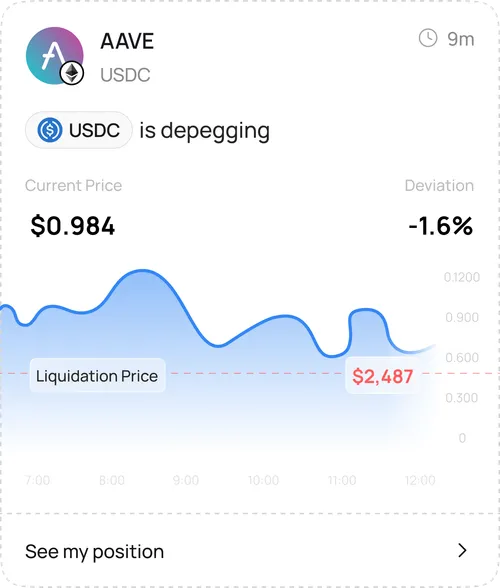

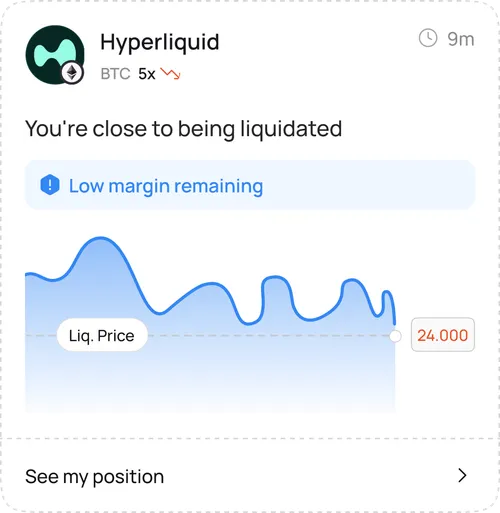

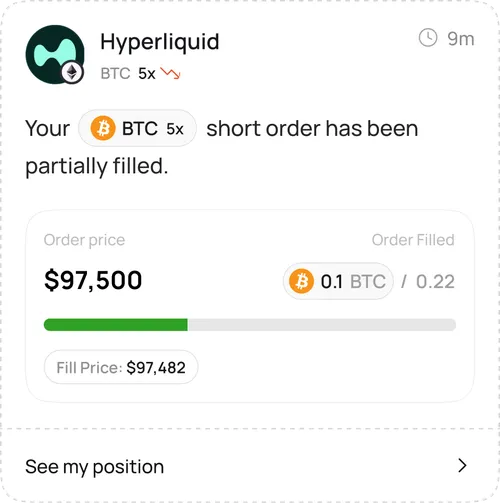

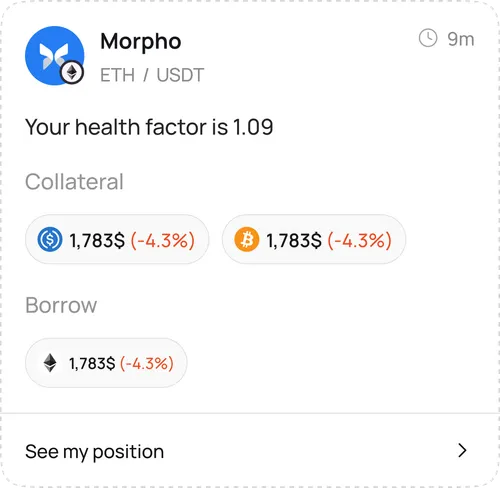

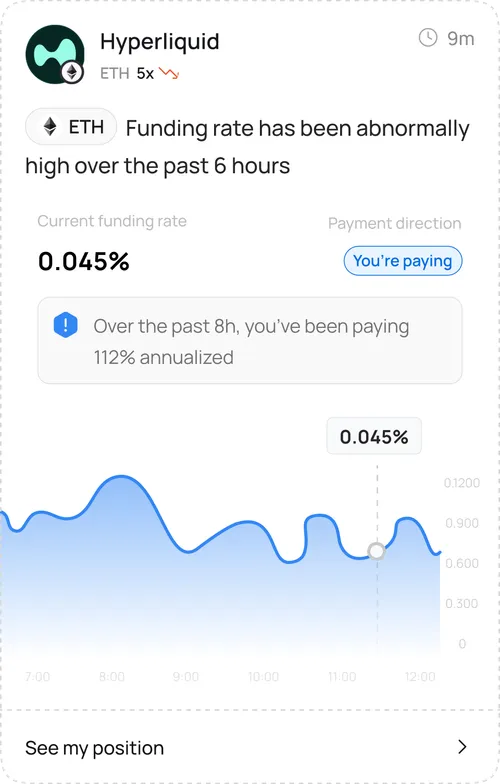

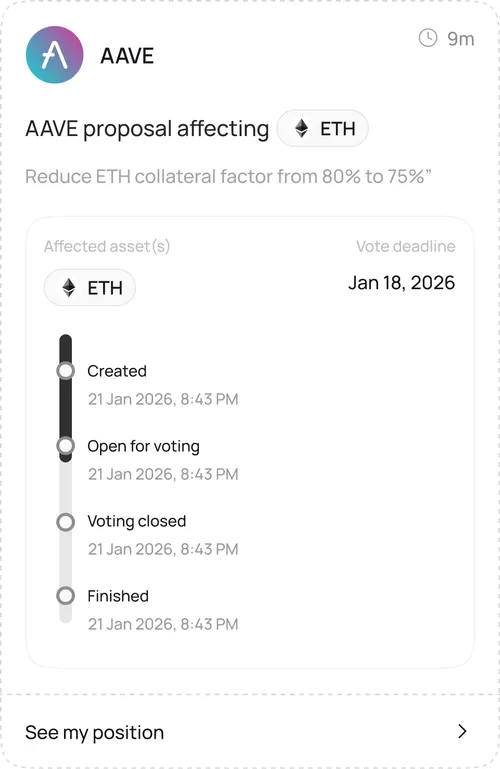

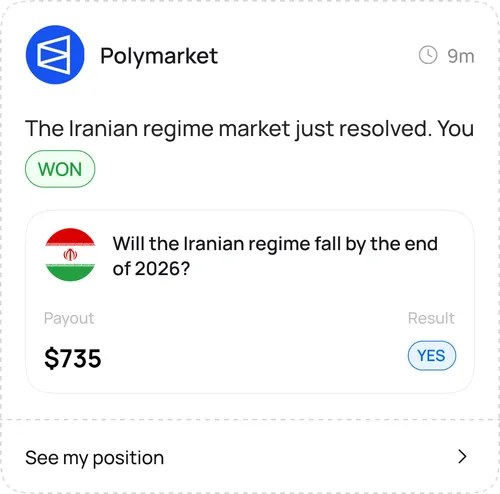

Smart Alerts

Signals, Not Noise.

Otomato alerts you only when something meaningful changes in your DeFi positions. No spam, no noise. That includes:

If nothing important changes, you won't hear from us. That's the promise. Unlike generic blockchain notifications, Otomato delivers on-chain alerts that are relevant to your actual positions.

Protocols

Alerts that actually help.

Beautiful, actionable notifications that give you exactly what you need to know.

The notifications we support as of today

These are the DeFi notifications you will start receiving today. More protocols and blockchain alerts are added every week.

Overall

Hyperbeat

Hyperlend

Hyperswap

Project X

Kinetiq

HypurrFi

Ventuals

Rysk

Felix

Hybra

Hypersurface

Hypurr NFTs

Hypio NFTs

Hyperliquid Names

Catbal

DotHype

Nest

Ultrasolid

Click on a protocol to see all supported notifications

FAQ

Frequently asked questions.

How do DeFi alerts work on Otomato?+

Do I need to connect my wallet?+

What protocols does Otomato support?+

What types of alerts can I receive?+

Is Otomato free?+

How do I receive alerts?+

Start monitoring your portfolio.

Get alerts when something changes. No signatures required.